Comprehensive Financial Overview

This report provides a detailed overview of the financial position and performance of the organization. It includes various statements and schedules to help in understanding the financial health and making informed decisions.

Key Sections:

1. Instructions:

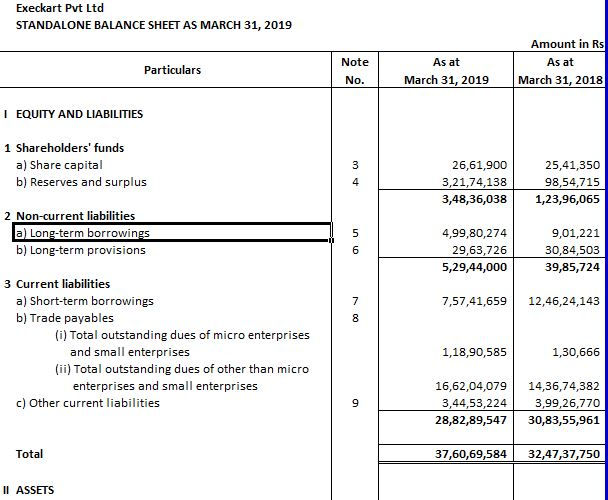

- Guidance on how to navigate and utilize the financial data provided in the workbook.2. Balance Sheet (BS):

- Presents the financial position of the organization, detailing assets, liabilities, and equity as of a specific date.3. Cash Flow Statement (CFS) and Working:

- Provides information about the cash inflows and outflows over a period, showing how cash is generated and used in operating, investing, and financing activities.4. Profit and Loss Statement (PL):

- Summarizes the revenues, costs, and expenses incurred during a specific period, showing the profit or loss.5. Notes (Note 1 & 2, PL Notes):

- Additional information and explanations regarding the financial statements, including accounting policies and detailed breakdowns.6. Detailed Schedules (BS1, BS2, BS3, BS4):

- Breakdowns of balance sheet items for more granular analysis.7. Fixed Assets Register (FA 18-19):

- Detailed register of fixed assets, including purchase cost, accumulated depreciation, and net book value.8. Trial Balance (TB 18-19 HO):

- A summary of all ledger accounts and their balances, ensuring that debits equal credits.9. Cash Flow (Cash Flow):

- Detailed breakdown of cash flow activities.10. Grouping and Sub Grouping:

- Classification of accounts and transactions into specific groups and subgroups for detailed analysis.11. Master Sheet:

- A comprehensive sheet that integrates all financial data for an overarching view.Highlights:

- Financial Position: Detailed balance sheets showing the organization's assets, liabilities, and equity.

- Performance Analysis: Profit and Loss statements providing insight into the financial performance over specific periods.

- Cash Management: Cash flow statements illustrating the cash movement and liquidity position.

- Asset Management: Fixed Assets Register detailing the status and value of long-term assets.

- Compliance and Accuracy: Trial Balance ensuring the accuracy of the ledger accounts.Benefits:

- Informed Decision Making: Comprehensive financial data to support strategic decisions.

- Transparency: Clear and detailed financial statements for stakeholders.

- Regulatory Compliance: Ensures compliance with accounting standards and regulations.

- Efficiency: Streamlined financial analysis through organized schedules and notes.---

This summary provides a snapshot of the contents and significance of the financial report, facilitating a better understanding of the organization's financial health.

Financial Statements

https://youtu.be/P5KJ8D__4C0